GST Information & Preparation Checklist

Do you prepare your own GST? Are you new to business, and are not sure if you need to file GST returns? What type of filer are you: monthly, quarterly or annual and what are the deadlines for filing and payment. We have included some helpful links to the experts, the Canadian Revenue Agency, to help you decide if you need to register, how to register and what to charge GST on.

GST Preparation Checklist

In order to file your GST, regardless of the filing period, your monthly reconciliations need to be completed up to your period deadline. In order for your bookkeeper to complete your reconciliations, they will need:

- Sales invoices

- Bills and Receipts for purchases

- Bank Statements

- Credit Card Statements

- Line of Credit Statements

- Loan Statements

Download GST Preparation Checklist PDF

Helpful Information regarding GST

Just starting your business? Do you need to register for GST? Visit https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/when-register-charge.html

If you need to register and you are not sure how to do so, visit https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/account-register.html to find out how.

Not sure whether you need to charge GST? Visit https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/charge-collect-which-rate.html for more information

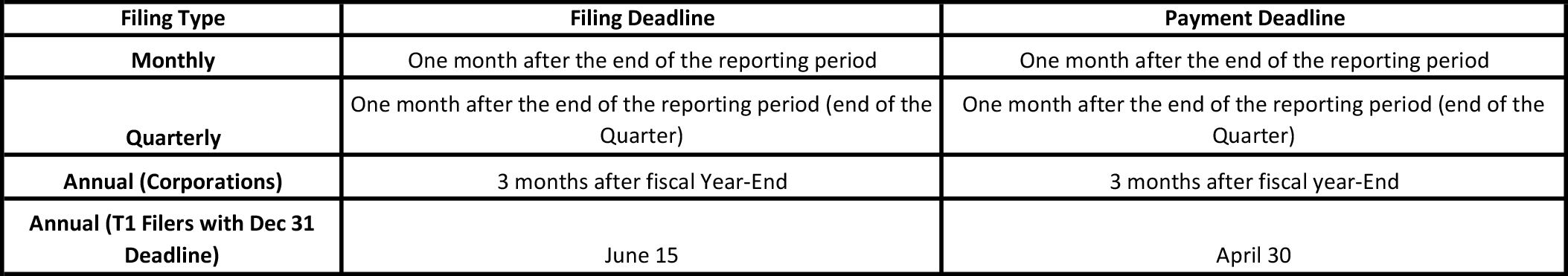

Do you know your GST Filing and payment deadlines? Visit https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/complete-file-when.html or see below chart.